Sample tax return calculator

Up to 10 cash back Estimate your tax refund using TaxActs free tax calculator. Ad Looking for estimate your tax refund.

How To Calculate Income Tax In Excel

This calculator will help you work out your tax refund.

. On taxable income of 142600 145600 less capital gain of 3000 at. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. See how income withholdings deductions and credits impact your tax refund or balance due.

Use the Simple tax calculator to work out just the tax you owe on your taxable income for the full income year. Content updated daily for estimate your tax refund. This 2022 tax return and refund estimator provides you with detailed tax results.

Enter your filing status income deductions and credits and we will estimate your total taxes. Once you have a better understanding how your 2022 taxes will work out plan accordingly. As a result they will increase your Tax Refund or reduce your Taxes Owed.

Your household income location filing status and number of personal. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Individual - Sample personal income tax calculation Last reviewed - 01 August 2022.

Ad Calculate your tax refund and file your federal taxes for free. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. This tax calculator is solely an estimation tool and should only be used to estimate your tax liability.

Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Based on your projected tax withholding for the year we can also estimate your tax refund or. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

An administrator can use this tool for all employees and individual employees will have access to. Based on your projected tax withholding for the. The Tax Caculator Philipines 2022 is.

Enter your filing status income deductions and credits into the income tax calculator below and we will estimate your total taxes for 2016. 1040 Tax Estimation Calculator for 2022 Taxes. Based on your projected tax.

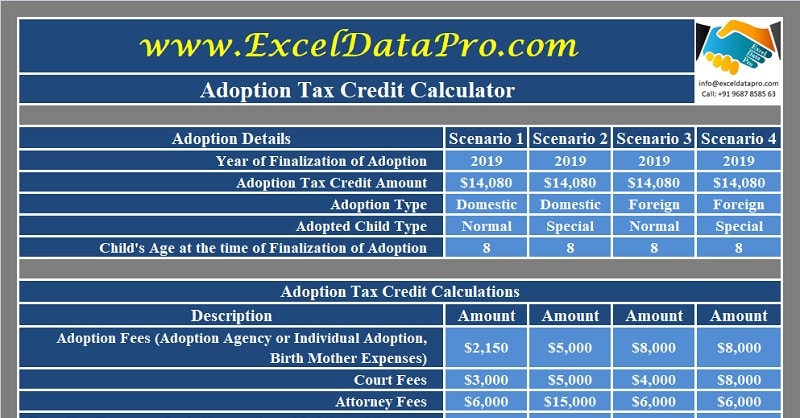

Enter your filing status income deductions and credits and we will estimate your total taxes. Federal Taxes Withheld Through Your Paychecks Adoption Senior Taxes You Paid When You Filed an IRS. Enter your filing status income deductions and credits and we will estimate your total taxes.

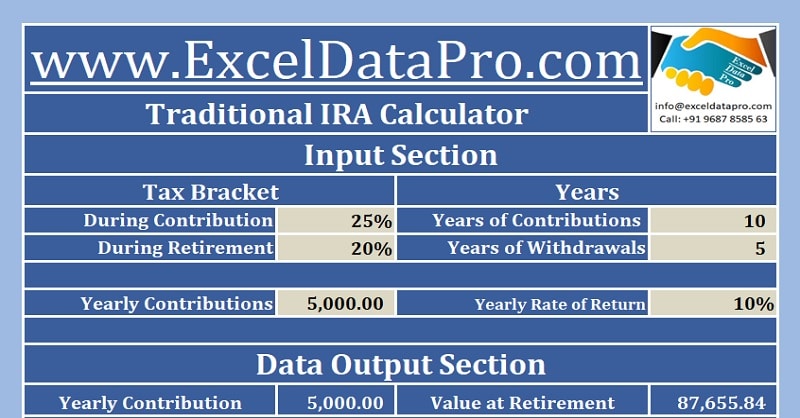

You can use the Sample Tax Calculator to estimate an employees net pay.

Income Tax Formula Excel University

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Free 12 Sample Income Tax Calculator Templates In Pdf

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Net Income After Taxes Niat

How To Calculate Income Tax In Excel

Income Tax Formula Excel University

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Download Free Federal Income Tax Templates In Excel

Free 12 Sample Income Tax Calculator Templates In Pdf

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Download Free Federal Income Tax Templates In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax Fy 2021 22 Excel Examples Income Tax Calculation Fy 2021 22 Youtube

Tax Refund Estimator Calculator For 2021 Return In 2022

Free 12 Sample Income Tax Calculator Templates In Pdf

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download